The following excellent and detailed case study of a West African mine – renewables feasibility was written by Renergetica. To meet and discuss this project at the Johannesburg Renewables and Mining Summit contact Marco Giannettoni from Renergetica at marco.giannettoni@renergetica.it

Reducing all-in sustaining costs (AISC) of a West African mine

There are several reasons why renewables are good for mines. The reduced overall environmental impact of the mining operations will be appreciated by neighbouring populations and future generations. The reduced energy costs and improved power grid reliability are of most interest to site managers experiencing the day-to-day challenge of achieving their budget goals. But the most effective measure of the value of renewables for mining companies is given by the impact they have on the actual overall costs for the production of the single unit of gold, silver, copper or whatever is the good they are digging.

The AISC – the All In Sustaining Cost – is currently the most recognized indicator among investors from the mining sector worldwide, especially but not only when dealing with precious metals, as it provides a quick and effective figure to be compared with the stock price of the extracted mineral, and it gives an immediate view of the economical health of the mine’s business. Investors fully appreciate reducing the AISC per unit of product for a given mine since this directly increases their revenues, more than the simple cash costs cut. When such a reduction is achieved by means of permanent improvements of the processing efficiency instead of because of lucky coincidences (like the drop of oil price or the currency exchange effects) or double impact decisions like mining to higher grades (which implies reducing ore reserves), the overall life of the mine and the duration of the revenues, are positively affected as are the attractiveness of the shares.

So some of the questions that energy managers and advisors might be willing to answer are:

– “What is the impact of renewables on the AISC of a given mine?”

– “Which are the factors that determine such impact?”

Well, these are in fact the questions that had been presented to Renergetica in relation to a mine in West Africa: The mine produces 130.000 oz of precious metal from open pit and underground excavation, and it is totally dependent on Diesel Gensets (DGs) for the electric energy on site, with a powerhouse with 22 MVA installed generators that feed a load as high as 16 MW, 24/7. Supplying oil to the site involves convoys of trucks travelling hundreds of miles over risky roads, several times a month, making the cost per kWh an issue for the competitiveness and profitability of the mine.

Qualitative answers came after a pre-feasibility study addressing renewables siting, energy resource estimation from a variety of sources, and budgetary evaluation of construction costs on site. It was found that the most interesting resource available on site was solar (an easy guess for this specific site, but wind, hydro and biomass are always worth evaluation), with a first estimation of the cost per kWh lower than 25 % of the cost that the mine was paying for powering itself with DGs. So, after a couple of weeks it was easy to anticipate the following:

The overall impact of installation of PV on AISC would be definitely positive, in a range between 5 US$ and 40 US$ per unit of product, depending on the following main factors:

- PV power vs. DGs power: in principle, the higher the better, but as PV power exceeds values around 40 % of the load demand, grid stability becomes critical, and specific technical solutions are required;

- Renewable energy penetration: providing renewable energy for night time demand increases the savings in the long run, but it implies the need to store excess energy produced in excess during the day. PV power penetration far beyond 100% and energy intensive storage systems are necessary: technical complexity increases and so does the initial investment;

- CAPEX, equity investment and resulting financial burden: solutions leading to higher CAPEX are also leading to higher AISC reductions. However, mining companies are more keen to invest capital in the expansion of mining activities rather than in energy projects serving their mines, at least until they clearly recognize that efficient energy production improves their position in the business and secures higher value of their shares;

- Mine life-time: this is the most delicate aspect, since a mines’ operation and life could be dramatically affected not only from the premature depletion of ore reserves, but also from the trend of the product prices: this explains why the project must assure a very short payback time (and/or a suitable exit way).

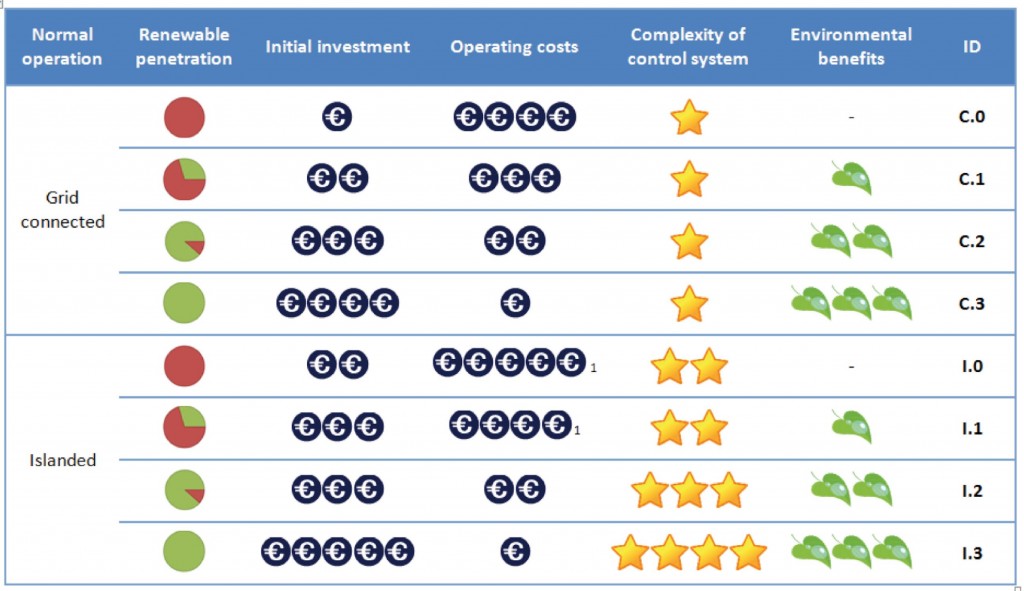

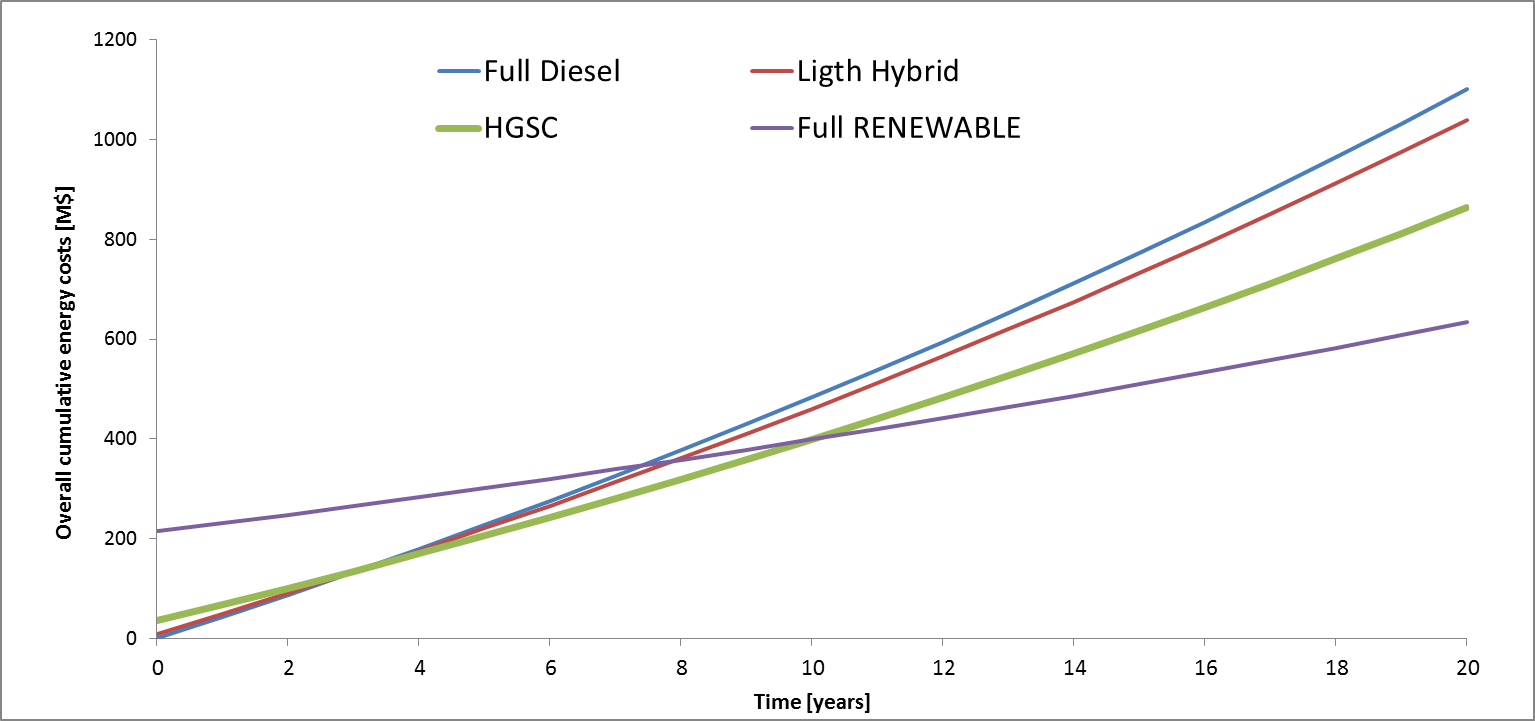

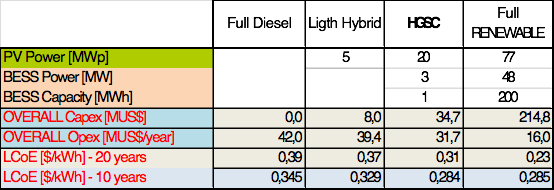

The figures and tables below sum up the overall picture of the hybridization options that were theoretically possible after the pre-feasibility study, with the relevant pros and cons on both economics and technical aspects.

A fully renewable solution was immediately discarded: the huge initial investment itself, and the long payback time made it unfeasible. This is something that will significantly change in few years from now if the cost of energy storage systems will go down.

On the other hand, a light hybrid solution, easy, with a payback time shorter than 3 years and achievable IRRs on equity close to 3 digits, was not that interesting as it does not affect the AISC of more than 0,8 % of the current value.

It was then easy to make the decision to move into a thorough feasibility study, addressing all the technical, administrative and financial aspects for a suitable, optimized and reliable hybrid solution, targeting a reduction of AISC of 2%, with an expected residual life time for the mine of no more than 12 years.

The study took some 16 weeks, necessary to:

– perform technical surveys on site,

– identify specific requirements and constraints,

– elaborate basic design of the plant and its integration with the existing power system,

– provide extensive energy harvesting analysis with verification of local data,

– synthesize optimal control techniques,

– specify key components and works,

– collect commercial offers from manufacturers and contractors to assess actual CAPEX.

At the same time, financing and intermediary IPP options were analyzed to provide the investors with the possibility of evaluating different levels of equity and relevant impact on AISC.

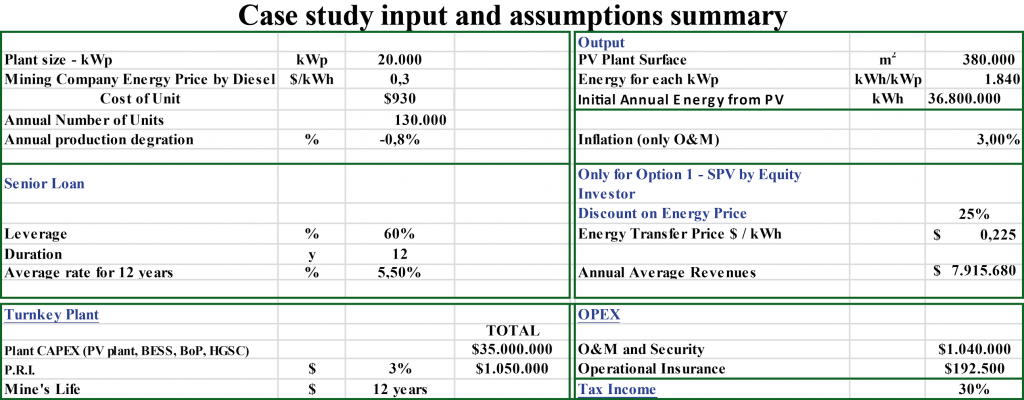

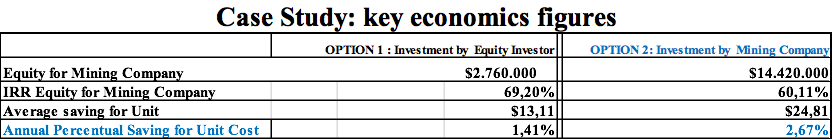

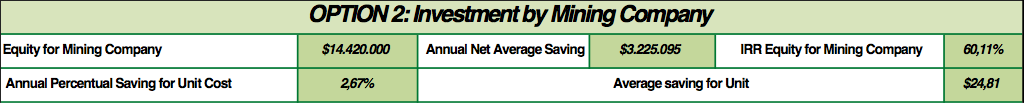

The following tables summarize the key figures characterizing the economical performances deriving from the hybridization of the mining site power system, for two different business model options:

Option 1 – The plant is financed, built and operated by an IPP selling renewable energy to the mining company according to a PPA;

Option 2 – The plant is financed and operated directly by the mining Company.

In both cases, going green makes a lot of sense, but it’s apparent that when the mining Company is the investor, the revenues are going to be the highest, resulting in an AISC reduction exceeding 2.6%.

And these figures do not consider the further benefits deriving from the greening of the Company operations as perceived by local population and authorities, nor the possibility to avoid at least part of the assumed dismantling costs at the end of mine’s life (e.g. the hybrid power system, or part of it, could be conveniently used by local population).

Now is time for the mining company to make a decision: are they going to make a step toward a permanent improvement of their process efficiency and balance sheets figures (betting on a mine’s life of 5 or more years), or are they going to start cost cutting actions at the expense of the mine’s life?

At Renergetica, we are further working on making their green decision even more convenient and safer.

For further information on Renergetica’s hybrid solutions and services:

www.renergetica.it/en

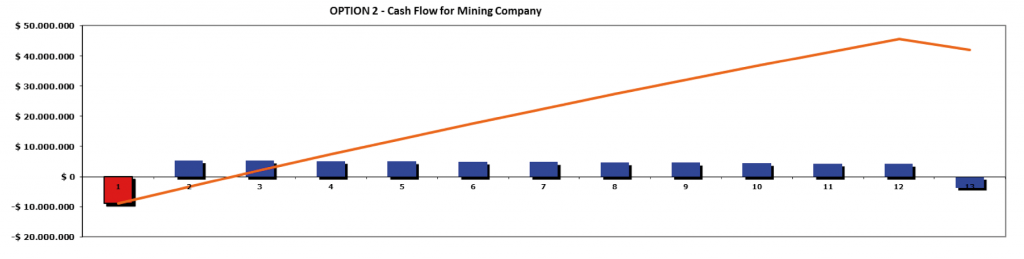

l.0 -Fully conventional system

A set of conventional generators, managed by a Master Control system, supplies the loads. The Master Control System performs the following functions:

– secondary frequency regulation

– load-sharing

– switching on/off the available generators to match the load demand

– tie-line control (only if running in parallel with a grid

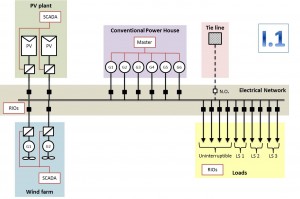

l.1 – Light hybrid system

Typical hybrid system where PV and wind resources simply join the grid to operate in parallel with a conventional Power House.

Grid stability requirements limit the penetration renewable power to a level that can be matched by conventional generators

Today this limit is below 40% of the power of conventional generators

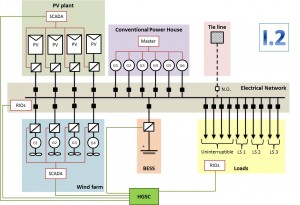

l.2 – Hybrid System with HGSC technology

Benefits from renewable systems can be increased with the use of the Hybrid Grid Smart Controller. HGSC coordinates the operation of PVs and wind generators, and a Battery Energy Storage System used to compensate rapid variations of the load request to conventional Power House.

HGSC has no interaction with the control system of the conventional Power House: this unique feature allows for smooth and safe transition from conventional grids to hybrid grids, with penetration of renewables that can reach 90%

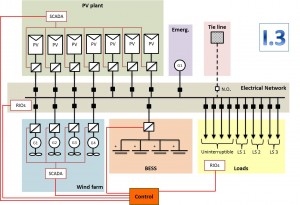

l.3 – Fully renewable generation system

A fully renewable generation capability minimizes the operating costs and maximizes the environmental benefits, but implies the highest initial costs, and requires the development of specific and critical control solutions assuring reliability of the system.

The renewable sources (i.e. PV or wind) are not available with the required continuity; so conventional sources are always necessary, together with energy and power intensive BESS facilities.