Arnoldus Mateo van den Hurk Mir, CEO of r4mining, is running a workshop on June 30th in Johannesburg titled: An introduction to mining for the renewables business. In this article, Arnold outlines why the present value proposition from the renewables sector doesn’t gain traction within mining. The article also presents some ideas on how to better position renewables.

Get started with new value proposition design

In the past five years, business schools, universities, multilateral agencies such as the World Bank, great multinationals and innovative SMEs use a new methodology for new business models generation. The “Canvas Business Model” developed by Alexander Osterwader and Yves Pigneur has meant a before and after in the solution of innovative value proposition and business model generation that could be of great benefit for the renewables for mining market. This value proposition design relies on two sides, one points to “Mining Customer Profile” where NCRE business developers clarify the understanding of mining, on the other side the “NCRE Value Map” describes how to create value for mining companies using renewables. The NCRE service providers achieve fit between the two when one meets the other.

Figure 1: The Business Model Canvas

Why renewable companies really want new business models for mining?

Below are some market obstacles in order to better understand the need for business model R&D

- Miners seem to be worried when energy business suppliers focus too much on NCRE products and technologies instead of creating customized value for mining.

- Because of the mineral commodities crisis and oil price volatility, NCRE developers are concerned without methodology to track the progress on the development for new business value propositions for mining.

- Unlike mining, NCRE business models are substantially different to residential, commercial, utilities, hotel, hospitals, agribusiness, chemical and any other common industrial sectors.

- It is hard to understand that mining is not a renewable business as well as a type of business with inconsistent lifespan cycle.

- The mines are physically isolated and miners are strongly conservative.

- Mines demand solution suppliers with highly specific technical preparation to figure out which a mine really means.

- It’s easy to understand the business model of an hotel or a winery but is not so easy to understand a diamond, gold, coal or iron ore mine, a smelter company, a metal commodity trading, or the difference between mineral resources and reserves, or differentiate between a pre-feasibility and a feasibility polymetal certified report, for example.

- In more complex environments such as microgrids, company energy suppliers need to invest in research and development and are then surprised when although they get an accurate technological solution, they fail to develop the right value proposition and business model to miners.

- Despite the good ideas, the excellent professionals, the company track records and good mentions in other industrial markets, NCRE companies try to use proven success strategies in other sectors but they feel disappointed in discovering these are proposals miner don’t want.

What if we try out proven value proposition methodology in innovative niches and apply them to renewables for mining projects?

The first step is the Observation of Customers, the set of mining characteristics that renewables business developers assume, observe, and verify in the market. The second step leads to the Creation of Value, the set of value proposition benefits, which energy developers design to attract miners. The third step will fit both previous ones.

The Value Proposition Design Step I: Mining Customer Profile

The Mining Customer Profile describes the mining specific segment in the business model in a more structured and detail way. It breaks the miners down into its jobs (1), pains (2), and gains (3).

- Mining Jobs describe what miners are trying to get done in their work and in their lives, as expressed in their own words.

- Mining Pains describe bad outcomes, risks, and obstacles related to mining jobs.

- Mining Gains describe the outcomes miners want to achieve or the concrete benefits they are seeking

Figure 2: The Mining Customer Profile

The Value Proposition Design Step II: Renewables Value Map

On the other hand the NCRE Value Map describes the features of a specific value proposition in the business model in a more structured and detailed way. It breaks the value proposition down to product and services (a), pain relievers (B), and gain creators (C).

a. NCRE Product and Services as a list of all the renewable energies product and services.

b. NCRE Pain Relievers describe how renewables products and services alleviate mining pains.

c. NCRE Gain Creators describe how the renewables create mining gains.

Figure 3: The Renewables Value Map

The Value Proposition Design Step III: The Fit

Finally the Fit process is subdivided to three parts: Problem – Solution Fit, Product-Market Fit and Business Model Fit (bankability).

Figure 4: Fit NCRE Value Map to Mining Customer Profile

Is it really necessary to invest in value proposition R&D in renewables for mining?

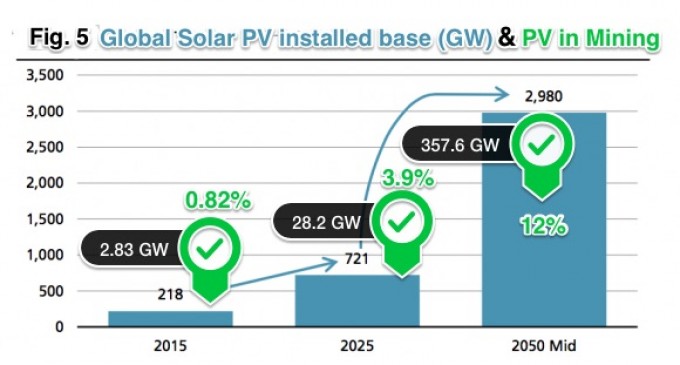

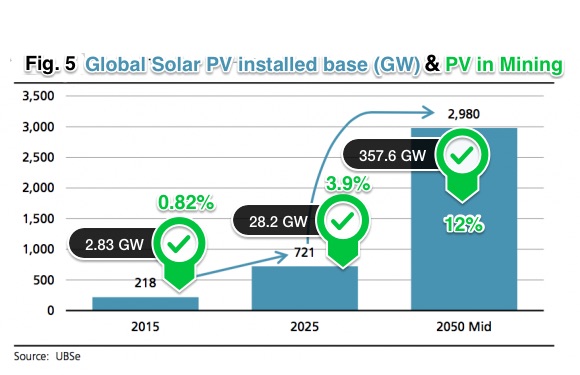

Yes, because a huge market is waiting of these solutions. Let us show you an example of world solar PV installed based on the recent global report by UBS (see figure 5) and our modification to apply this to mining market. The conclusions of a new analysis from UBS point to a 10% solar PV global electricity supply by 2025 with 721GW installed tripling the current capacity and then triple again between 2025 and 2050. By the middle of the century, UBS estimates that nearly 3,000 gigawatts of solar will be installed worldwide.

Currently global mining consumes a 8% to 12% range on global primary energy, as an example of one of the mining phases, the comminution, which triples the electricity annual consumption of Germany.

The rate of increase of electricity demand in mining will exceed the world average because of

- the decline in mineral concentration (mineral law).

- longer transportation routes due to remoteness and increasing depth of the mines.

- the increase of world market size for minerals and metals to a 9 billion-world population by 2050.

- mining power demand could even double if we add the potential migration from diesel to electricity mining vehicles based on next 35 years energy storage experts’ forecasts.

- the mining power market share will likely significantly exceed the current 8 to 12% market share achieving 15% to 20% share; even so, we prefer to be conservative and maintain only a 12% of potential share by 2050.

Therefore, if investments in solar PV would amount $3 trillion according to UBS over the next three and a half decades, $360 billion would correspond to mining based on our market share predictions.

And now what?

Pre-workshop Johannesburg and Mining Jobs on 30th June at the Renewables and Mining Summit Johannesburg, Energy and Mines will celebrate the second Pre-workshop “An introduction to mining for renewables professionals” centered to the Step I.1 of the value proposition design, the Mining Jobs with some comments about Mining pains (I.2.) and Mining Gains (I.3.).

For further details of the workshop contact andrew.slavin@energyandmines.com