Joel Link is SolarReserve’s Vice President of Development. He is responsible for business development and power marketing of large scale solar thermal and photovoltaic (PV) energy projects throughout the Americas and Asia. In addition to his development role, Link also leads expansion of the company’s activities for on and off-grid solar thermal and PV solutions uniquely designed to deliver significant savings and predictable energy costs to mining operations around the globe.

SolarReserve will be sharing its experience building bridges between mining and renewables at the Energy and Mines Toronto Summit next Oct 22-23.

Q: SolarReserve has been looking at the market potential of solar for mines for at least 3 years now, can you give us an update on the project appetite and discussions you are having with mine off-takers?

A: Although adopting the use of renewable energy has been slow to start, it is now rapidly becoming an accepted alternative by mining companies as a way to reduce energy costs, while providing reliable power without carbon emissions. Recently, mining companies have struggled with low commodity pricing, which affects their investment decisions in new mining projects, but also creates an opportunity for renewable energy developers to help mining companies hedge their exposure to volatile fuel pricing in the future. While it has been challenging to break through to the mining sector, SolarReserve is in active negotiations with several mining companies for the sale of baseload solar power. In addition, SolarReserve is participating in a number of mining company power solicitation tenders.

Q:What are the latest updates on your project for a Chilean mine – and do you see more potential in Chile for partnerships with mining operators?

A:In August, SolarReserve’s Copiapó Solar Project in the Atacama received environmental approval from the Chilean government – an important milestone for the future of power generation of Chile’s mining sector. As part of SolarReserve’s project development and permitting process for the Copiapó project, the company collaborates with stakeholders and local communities to ensure minimal environmental impact. This process includes careful site selection, low water use systems, and extensive environmental studies prior to starting construction. The Copiapó project underwent comprehensive environmental assessment under the Chilean Impact Assessment System (Sistema de Evaluación de Impacto Ambiental – SEIA) administered by the Environmental Evaluation Service (SEA), and as a result was successfully awarded an environmental qualification resolution (Resolución de Calificación Ambiental) (RCA), which is the name for the Chilean environmental permit.

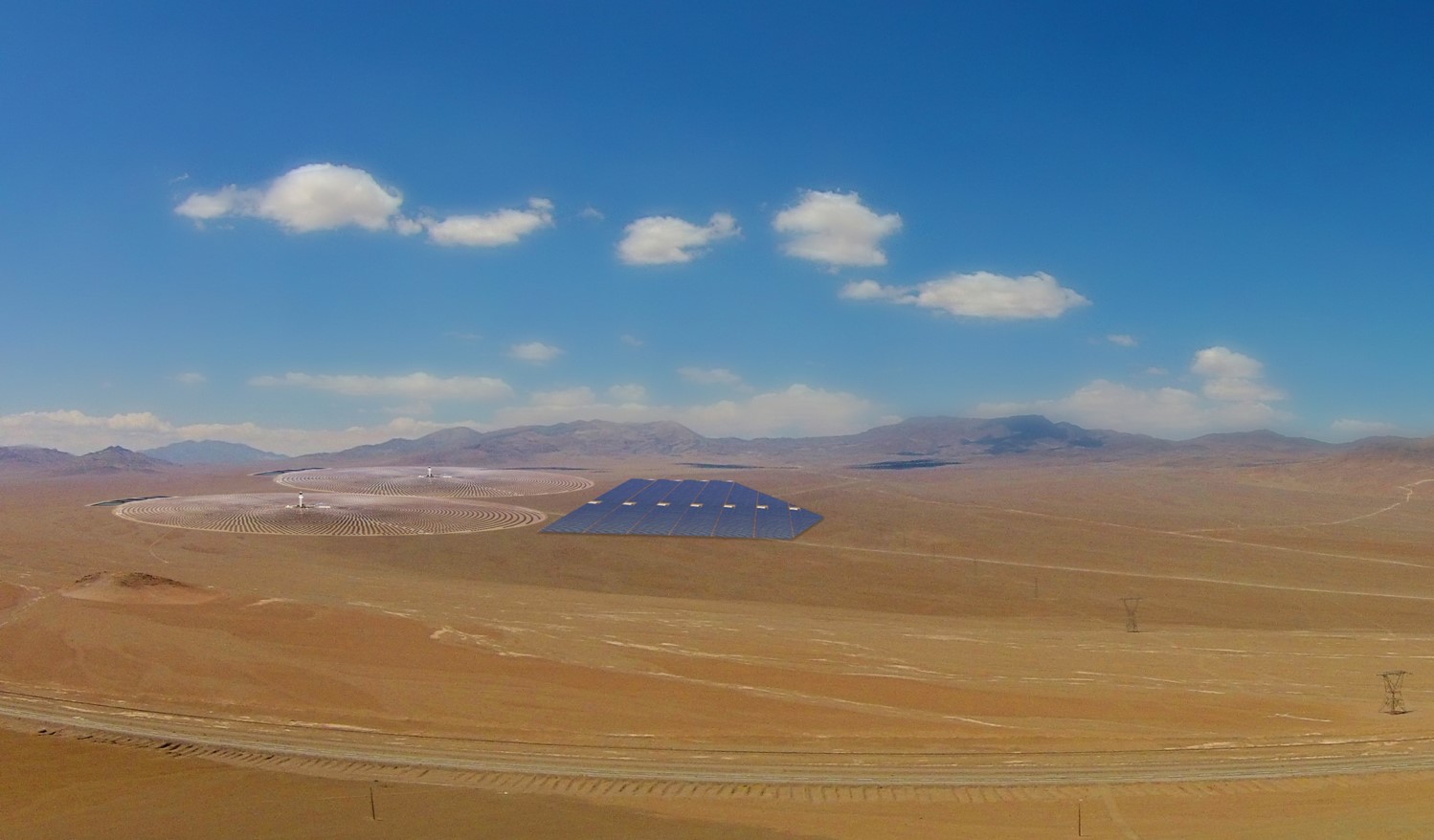

The Copiapó project consists of SolarReserve’s industry leading concentrating solar power (CSP) tower technology with molten salt thermal energy storage combined with solar photovoltaic panels (PV). This hybrid concept will maximize the output of the facility, delivering over 1,800 gigawatt hours (GWh) annually, while providing a highly competitive price of power. It will produce up to 260 MW’s of firm baseload power which is critical to Chile’s industrial sector, particularly the mining companies; operating at a capacity factor and availability percentage equal to that of a coal fired power plant. No other proven renewable energy technology can provide this cost competitive energy solution to meet the needs of Chile’s largest and most important industries.

SolarReserve is actively developing/permitting over 800 MW of CSP projects in Chile – including the Copiapó Solar Project. The Chilean government, mining sector, and capital markets are all extremely supportive of the deployment of this disruptive technology that will provide baseload (24×7) power to Chile’s resource sector and promote energy security for a country that relies on imported coal, diesel and natural gas.

The Copiapó Solar Energy Project, located in the Atacama Desert in northern Chile, will deliver over 1,800 gigawatt hours (GWh) annually, while providing a highly competitive price of power. With 14 hours of full load storage, it will produce up to 260 MW of 24/7 firm baseload power which is critical to the mining sector; operating at a capacity factor and availability percentage equal to that of a coal fired power plant.

Q: Now that you have experience with the mining sector, how are you positioning your offering to further meet mining’s energy challenges and demands?

A: Mining companies are fundamentally looking to reduce energy costs and exposure to fuel volatility, while ensuring energy security. We are seeing, particularly for mines in remote locations, that energy storage is becoming increasingly important. And as the percentage of intermittent renewable energy such as wind and photovoltaics (PV) being deployed by the mining industry increases, the need for energy storage becomes vital.

There are various types of storage solutions, some offer short duration and others bulk storage. The mining industry is realizing that CSP with integrated molten salt is a leading solution for bulk energy storage. While battery technology continues to improve, progress is incremental, and costs are prohibitive for large scale installations. Batteries will cost hundreds or thousands of dollars per kilowatt-hour of storage capacity, not to mention degradation and replacement costs, but molten salt is about $65 for a kilowatt-hour of storage and will last for 30 years or more.

Additionally, SolarReserve’s solution provides both energy generation as well as energy storage, at a price competitive with conventional generation. We configure custom solutions based on the generating capacity, load factor, solar resource, level of fuel reduction, grid power availability, and degree of power infrastructure replacement desired. Our solar thermal technology with molten salt energy storage can typically offer a capacity factor of 80%-90% from solar energy alone, depending on the strength and consistency of the sunlight. For full 100% availability in off-grid scenarios, a relatively small amount of diesel fuel can be used on cloudy days.

Q:What other markets are you targeting for partnerships with mining operators – where does your solution make the most sense for mines?

A: We have seen that demand from mines is primarily driven by high and unstable fuel costs and increased pressure on reducing operating costs. There are not many cases where local regulations limiting fossil fuel use are strong enough to force mining companies to adopt renewables. A solution such as ours that can provide cost competitive power at a predictable fixed price for the life of the mine makes good business sense and enables mines to hedge against future energy price increases in almost any market. The opportunities we are pursuing are with large mines that have high energy costs and suitable sunlight. In the past year we have interfaced with iron, copper, gold, silver, and uranium mines in Australia, Mexico, South Africa, and the United States. The very best opportunities are in off grid locations such as in Western Australia, where fuel cost for diesel is more than $300 per megawatt-hour. In the right locations, we can provide energy for well under half of that, delivering a reliable 24-hour per day power solution.

Q: What do you think the main challenges are currently for mines to move forward with utility-scale solar solutions that offer baseload power as does SolarReserve’s offering?

A:Technology risk as well as length of power contract term have been the challenges for mines to move forward with SolarReserve’s baseload solar power offering. However, SolarReserve’s flagship project in the U.S., Crescent Dunes, has completed construction and will be online this year. With Crescent Dunes to serve as an example of our technology’s capabilities, the risk associated with the technology will abate. Mining companies will recognize the value of solar with storage as a viable energy solution. In fact, The Crescent Dunes facility is currently in late stages of commissioning, but the key proprietary technology provided by SolarReserve has already been proven and is actually over performing. The receiver, which is the heart of the system, is performing in excess of design expectations both in terms of heat transfer efficiency and the pressure drop through the receiver panels. This is a genuine indicator for performance of this and our future projects, and validation of the industry-leading solar thermal with storage technology developed here in the US.

Q:What does the renewables sector need to better understand about mining’s energy priorities to unlock the potential for further collaboration?

A: A mining customer is very different than a typical electric utility customer. Whereas an electric utility develops a long range resource plan to serve its customers and is willing to contract for 20 or more years, a mining customer typically has far more business variables to consider and is reluctant to enter into long term power contracts. This, in turn, makes it difficult for a developer to secure non-recourse project financing for his project since the revenue stream is contracted over a shorter term and often is not sufficient to service debt. In addition, a mining customer’s investment decision is based on commodity price market forces that continually change thereby further adding uncertainty to a mine’s ability to contract power under traditional long term power purchase agreements. In order to be successful, a developer should consider innovative financial structures including power hedges, contract for difference structures, and equity partnership with the mining customer.