Vince Peckham

Chile’s state-owned copper giant Codelco’s announcement today of another round of layoffs is just the latest sign of an industry under stress. Copper has recovered from six-year lows struck late August on the back of supply cuts by major producers but at around $2.30 a pound or $5,000 per tonne on Tuesday there isn’t much breathing room for producers.

The latest estimates by the Lisbon-based International Copper Study Group paint a very different picture from the previous forecast made in April. The market is now expected to be broadly in balance this year and to fall into a deficit of 130,000 tonnes in 2016. This compares with April’s forecasts of surpluses of 364,000 and 228,000 tonnes respectively.

Despite a $4.2 billion expansion project output at the world’s largest copper mine output will fall by 17% this year

According to ICSG World mine production, after adjusting for expected disruptions, is expected to increase by around 1.2% in 2015 to 18.8 million tonnes. 2014 recorded similar growth rates. The expected market shortfall in 2016 will be against a backdrop of higher mine output of around 4% expected next year.

The copper industry has a long history of these supply-side surprises however. Typical disruptions associated with adverse weather (exacerbated this year and next by El Nino, which create droughts on one side of the pacific and floods at the other), technical problems, power shortages and labour activity coupled with falling grades and dirty concentrates at old mines (pushing up unit costs) make forecasting a tough proposition.

Expansions, expansion, expansion

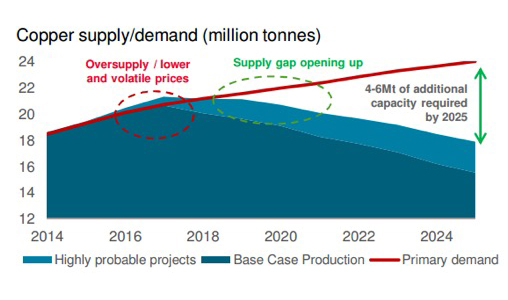

Longer term Wood Mackenzie predicts a 10 million tonne deficit by 2028. Supply to fill this gap is expected to arise from expansions at existing operations, ramp-up in production from mines that have recently come on stream and output from a few new mine projects. Crucial for the direction of the copper price are the development activity from copper’s top tier.

The world’s ten largest copper mines produced 4,315.2kt of fine copper in 2014 representing about 23.3% of the world total according to ICSG. But the fact that Codelco, which vies with US-based Freeport-McMoRan Copper & Gold as the world’s number one producer of the metal, is spending $25 billion over the next several years just to keep output steady is also telling.

Our top ten copper mine ranking is based on data fromwww.IntelligenceMine.com:

Search, organize and map a global database of more than 45,000 mining company and property profiles

Another indication of to what extent the copper price is dependent on the performance of a few giant operations is Escondida, the complex of mines and plants in Chile owned by BHP Billiton and Rio Tinto. Escondida is a truly massive complex and the only mine to produce more than a million tonnes per year. Operator BHP in May completed a $4.2 billion expansion and is spending another $3.4 billion on water facilities. Despite the billions being spent, Escondida’s output will fall by more than 200,000 tonnes this year as record material mined is offset by a sharp decline in grades.

The top ten list based on data from IntelligenceMine, a sister company to MINING.com, will look different in coming years.

Freeport’s Grasberg mine in remote Indonesia didn’t make it to the 2014 list. Grasberg is worthy of mention however, as it produced 295.3kt (420kt in 2013) of copper and 1,132 koz of gold and boast one of the world’s largest reserves for both metals. Freeport is expecting lower output in 2015 due to the El Nino weather effect, but the iconic mine is bound to make a comeback as it completes the transition to underground over the next several years.

A tripling of capacity at Cerro Verde will catapult the century old mine into the top three global copper operations by 2017

While Freeport has made cutbacks at existing operations it’s going ahead with the expansion of the Cerro Verde copper and molybdenum mine in Peru, which has been in production since the mid-1800s. Capacity at the concentrator plant at the open pit is being tripled to 360,000 tonnes per day and should catapult Cerro Verde to the top three global copper operations by 2017.

New mines such as Las Bambas, owned by China-backed MMG, will produce on average 400,000 per year in its first 5 years of production. Construction at the Peruvian mine is nearly complete and the Australia-based MMG expects first production of concentrate in the first quarter of 2016. Last month the copper price got a boost when deadly clashes at the mine forced Peru to declare a state of emergency in the region. More evidence that even sure bets like Las Bambas – acquired by Chinese investors from Xstrata at the time of the merger with Glencore – are prone to disruption.

Oyu Tolgoi mine has one of the world’s largest copper and gold reserves and is currently operating as an open-pit in Mongolia. Oyu Tolgoi is expected to produce an average of 430,000 of copper and 425,000 oz of gold per year over its mine life. Full production following a $5 billion underground expansion is expected in 2021 and at full tilt the mine will represent nearly a third of the country’s GDP. Rio Tinto-controlled Turquoise Hill Resources holds 66% and the Mongolian government the remainder.

The giants of copper mining

- Escondida

The Escondida Complex, located in the Atacama Desert, is the largest of Chile’s big seven, contributing 1.14 million tonnes (Mt) fine copper in 2014. This represents 6% of the world’s copper output and roughly 20% of Chile’s output. C1 cash costs of US$1.07/lb are among the lowest in the industry and are expected to drop to US$0.91 in 2016. In 2014, gold at 72.90koz and silver at 4271koz are important by-products. Minera Escondida is owned by BHP Billiton (57.5%), Rio Tinto (30.0%), and Mitsubishi and Nippon Mining and Metals (10%) and Jeco 2 Ltd (2.5%). Escondida Complex has the capacity to move 1.3 Mt of material per day from the two operating mines, Escondida and Escondida Norte. Both deposits are supergene-enriched copper-molybdenum porphyries. Minera Escondida reserves total 26.2 Bt grading 0.523% Cu translating to a reserve life of 54 years (as of 30 June 2015). Copper in sulphide mineralization is recovered through two existing processing options: high grade is treated by conventional flotation at one of three concentrators (153.7 million tonnes per annum capacity; (Mtpa)) to produce copper concentrate (844.7kt in 2014) while lower grade is treated by a run of mine bio-leaching and subsequent solvent extraction (SX) and electrowinning (EW) producing copper cathodes. Copper in oxide mineralization is recovered through the acid leaching-SX-EW process plant. The cathodes (308.0kt in 2014) are transported by rail to ports at Antofagasta and Mejillones and concentrate is transported by two 168km Escondida owned pipelines to its Coloso port facilities. A new 152ktpd concentrator and a new leach pad were completed in late 2014 to help process more material which is important as grades are expected to fall 27% by 2016.

- Collahuasi

Collahuasi mine, a copper-molybdenum porphyry deposit, located 370km north of Escondida, is the second largest producer in our list at 470.4 thousand tonnes (kt) fine copper representing 8% of Chile’s total output. The Collahuasi operation, operating over 4,400 metres above sea level (masl), consists of three open pits and a concentrator producing 445.4kt which is fed through a 203 kilometre slurry pipe to Puerto Patache. In 2014, 25.0kt of cathode was also produced via the SX-EW process. The mine also produced 6125t of molybdenum in concentrate in 2014. C1 cash costs have been reduced to US$1.42/lb in 2014 from US$1.48/lb in 2013 and US$2.08/lb in 2012 returning costs to the second quartile in the industry. Over the same three years production has gone from 282kt to 470kt in 2014. In September 2015, Collahuasi decided it would cut production by 30,000 tpy due to lower copper prices. In terms of resources, the Collahuasi deposit ranks third in the world at 9.96 Bt with an average grade of 0.82%, including 3.25Bt of reserves with an average grade of 0.80%. Minera Dona Ines de Collahuasi, the owner, is held by Anglo American plc and Glencore, each at 44%, with a Japanese consortium Japan Collahuasi Resources B.V. headed by Mitsui and Nippon owning the remaining 12%.

- El Teniente

The first CODELCO owned mine in the list and number three overall in fine copper produced in 2014 is El Teniente. This mine also has the distinction of being the world’s largest underground copper operation and the sixth largest copper mine in terms of reserves with 1.67Bt grading 0.925% copper. Total refined production in 2014 was 452.1kt copper, 7496 t molybdenum, 3.110 Moz silver and 25.8koz gold. The daily mining rate is approximately 137,000 tonnes per day (tpd). The deposit is another porphyry type located 80km south of Santiago, in the Andes mountain range. El Teniente is undergoing an extensive $5.4bn expansion project called the New Mine Level project, which will extend the mine’s production life by 50 years by accessing a further 2.02 Bt of reserves grading 0.86% copper and 220 ppm (parts per million) molybdenum. The project is 35% complete and is two years behind schedule and USD2 billion over budget. El Teniente is yet another example of a large tonnage copper mine in a tough market facing decreases grades but being helped financially by cost cutting measures, lower energy and fuel costs, and favourable exchange rates.

- KGHM Operations

KGHM operates three underground copper-silver mines and remaining mine life, Lubin (45 years), Runa (31 years) and Polkowice-Sieroszowice (40 years), three smelter and refineries and a copper wire rod plant in close proximity to Lubin, southwestern Poland. The three mines produced 420.4kt of copper, 44.304 Moz silver, and 82.8koz gold in 2014 from the Kupferschiefer ore which makes it the fourth largest copper mining operation worldwide and the first non-Chilean mine. Other commodities mined include rock salt, molybdenum, nickel, rhenium, lead, and platinum. C1 copper cash cost in 2014 was US$1.82/lb placing KGHM between the third and fourth quartiles on the global cost curve. The average weighted global C1 cost of metal production for 2014 was US$ 1.55/lb based on Wood Mackenzie data. KGHM attributes unfavourable exchange rates in the first half of 2014 and the new mineral extraction tax implemented in 2012 as major reasons for recent C1 cash cost increases. KGHM is the eighth largest copper producer and the largest silver producer in the world. A new project called “Deep Glogow” began producing for the first time in April 2014 with production coming from below 1200m. The project contains 265.5 Mt grading 1.66% copper and 54 ppm silver with a mine life of 40 years. Infrastructure from the Rudna and Polkowice-Sieroszowice mines is used to access Deep Glagow. Total reserves of all of KGHM Operations are 17.48Mt copper and 52.4 million kg of silver.This table was produced using data from IntelligenceMine which features a powerful multi-faceted search with comparative result grids, sorting and download capabilities. Find out more at www.IntelligenceMine.com

5. Los Bronces

Los Bronces is an open-pit copper-molybdenum mine located in the Andes, 65 kilometres northeast of Santiago at 3,500 masl. Infrastructure includes copper sulphide ore treatment plants, a 56-kilometre slurry pipeline, copper and molybdenum floatation plants and two solvent extraction electro-winning (SX-EW) plants for the low-grade ore dump leaching process. The fifth largest copper producer in this list is 50.1% owned and operated by Anglo American, while Mitsubishi owns 20.4%, and CODELCO and Mitsui hold 20.0% and 9.5%, respectively. Mine production is 145 Mt/y with production from Los Bronces totaling 404.5kt fine copper with 368.3kt copper in concentrate and 36.2kt cathode in 2014. Declining grades and ore hardness have posed a challenge for the mine over the years, however, by 2016 production should be back to 38Mtpa. The mine has C1 copper cash costs of approximately USD0.90/lb placing it in the lower quartile of the cost curve. Remaining reserves of 2.06Bt grading 0.51% copper and 0.014% molybdenum give Los Bronces approximately a 35 year reserve life. Recently, production was affected by water shortages as central Chile has seen a record breaking drought in 2015. Los Bronces may go underground, however, that development will not happen before 2020.

6. Los Pelambres

Los Pelambres open-pit is number six on our list. Minera Los Pelambres, the owner and operator, is 60% owned by Antofagasta plc with Nippon at 25% ownership, Mitsubishi at 10% and Marubeni at 5%. Los Pelambres is a sulphide deposit in the Coquimbo Region, central Chile, 240 km northeast of Santiago. It produces copper concentrate (containing gold and silver) and molybdenum concentrate through milling and flotation. In 2014, 391.3kt copper, 66.5koz gold and 7,900t molybdenum were produced at a C1 copper cash cost of USD1.18/lb. Copper and molybdenum production has been declining in recent years due to lower grades and harder ore, however, a new expansion project is in the feasibility stage which will increase throughput from the current 175kt/d to 205kt/d at an estimated cost of USD 1.2 billion and includes a new desalination plant, grinding circuit and floatation plant. This expansion, if given the green light by the government, will lead to an average copper production increase of 40 to 45kt of copper per year. Current reserves are 1.4Bt grading 0.59% copper, 0.045 g/t gold and 0.019% molybdenum. In a unique way of cutting costs, Antofagasta holds a 30% interest in the El Arrayan wind farm, which started supplying Los Pelambres with power under a 20-year contract at an average of 40MW, approximately 20% of the mine’s total energy requirement.

7. Morenci

The Morenci complex is located in southeast Arizona, and is number seven in the list. It is owned 85% by Freeport-McMoRan and 15% by Sumitomo. The copper-molybdenum porphyry deposit produced 368.8kt copper in cathode and concentrate in 2014. To date, a significant mill expansion from 50,000 tpd to 115,000 tpd was nearly complete which will allow additional sulphide ores to be processed. As a result, Morenci’s copper production is expected to average over 480 kt over the next five years which would make it the second largest copper producer in the world. Molybdenum production will also increase to approximately 4kt over the same time from its current level of approximately 0.5kt. Total electrowinning tank house capacity is approximately 900 million pounds of copper per year. Morenci’s concentrate leach, direct-electrowinning facility, which was placed on care-and-maintenance status in early 2009, is expected to resume operation during 2015. The life of mine is 23 years. The current reserves are 9.7Bt grading 0.25% copper and 0.002% molybdenum.

8. Antamina

Located in the Andes of north-central Peru, 270km northeast of Lima, the eighth mine in this list is unique in that it is predominantly a polymetallic skarn with associated regional porphyry mineralization. Mined by open-pit methods, the deposit consists of a central core of copper mineralization with an outer band of copper-zinc ore. Antamina produces separate copper, zinc, molybdenum and lead/bismuth concentrates, with silver predominantly contained within the copper concentrates, with additional silver contained with the lead-bismuth concentrate. Antamina is one the lowest cost copper mines in the world. Nominal milling capacity is 52Mtpa. Concentrate is sent through a 304km slurry pipeline to port facilities at Huarmey. During 2014, 345kt copper, 211kt zinc, 1.42kt molybdenum, 12Moz silver and 5.6kt lead were produced. In spite of record mill throughput, lower grades in 2014 resulted in 30% lower copper production compared to 2013. Remaining reserves are 0.647Bt grading 0.94% copper, 0.98% zinc, 234ppm molybdenum and 10.7 g/t silver. The estimated mine reserve life is 13 years. Compania Miñera Antamina S.A. is the owner and operator with BHP and Glencore at 33.75% interest each, and Teck holding 22.5%, and Mitsubishi at 10%.

9. Chuquicamata

The CODELCO owned Chuquicamata copper-molybdenum porphyry mine is located in northern Chile, 250 km northeast of Antofagasta and is ninth in our list. In 2014, the current open pit operation produced 340.4kt of fine copper in cathode and copper concentrate and 14.6kt molybdenum, 757t gold, 186.9t silver and 1.0 million tonnes of sulphuric acid at C1 copper cash costs of approximately USD0.90/lb. Current mine reserves stand at 0.902 Bt grading 0.83% copper. The mine operates as an open pit but underground construction began in late 2011 which will access 1.7Bt of reserves grading 0.7% copper and 502ppm molybdenum (approximately 40 years of mine life) and as of December 2014 construction was 92.4% complete with first production scheduled for 2018. Production from Chuquicamata underground will be 320kt copper and 15t molybdenum per year once the transition is complete.

- Radomiro Tomic

Radomiro Tomic, another open-pit copper porphyry, rounds out the list of top ten list. The operation is located in the Chilean Andes, 4km from Chuquicamata mine and is also wholly-owned by CODELCO. Radomiro Tomic produced 327.3kt of copper cathode and 0.90kt molybdenum in 2014. Total reserves in 2014 are 2.06Bt grading 0.50% copper which is the largest copper reserve for any CODELCO mine. Copper production from oxide ore is declining and is due to fall quickly in the coming years. As a result, CODELCO is developing the lower grade sulphide reserves to extend mine life to 40 years by accessing 2.67 Bt of mineral resources grading 0.47% copper. A new 100,000tpd concentrator plant is part of the plan with ramp-up beginning in 2019. Radomiro is expected to reach a total of 354kt fine copper production at completion.