Via: Bloomberg

Renewable energy and China’s economic shift toward consumer-led growth will be major catalysts for a new wave of copper demand that’ll accelerate a shortage forecast to develop from 2019, according to BHP Billiton Ltd., the world’s largest mining company.

“The real spark, though, is the demand for renewables,” said Jacqui McGill, asset president for BHP’s Olympic Dam copper mine, the world’s fifth-largest deposit of the metal. “Regardless of where the energy’s coming from, it needs copper.”

Mining companies, including rival Rio Tinto Group, are racing to meet the forecast global deficit as output is constrained at existing mines on lower grades. By 2040, the share of global electricity generated from renewable energy sources, including solar and wind, will double to 46 percent, Bloomberg New Energy Finance estimates

“Renewable energy needs a lot of copper and is one of the best conductors for transmitting solar energy to wind energy,” said McGill, who is studying options to potentially more than double output at the mine in South Australia to 450,000 metric tons a year.

Hydro Systems

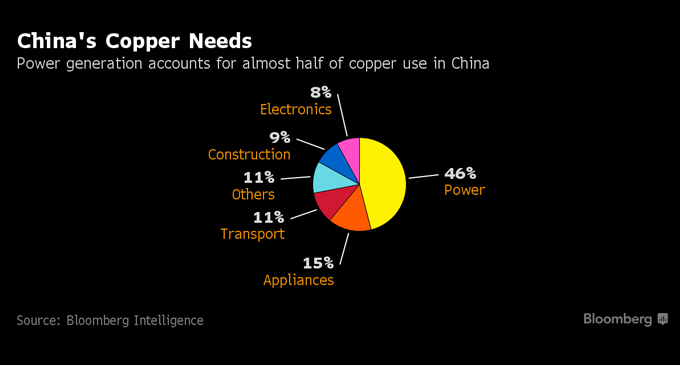

Chile, the largest copper producing nation, sees prices poised to rise by about a third over the long term on growing demand from China, where power generation accounts for almost half of the metal’s usage. Copper may average $6,330 a ton after 2018, according to the Chilean Copper Commission. The metal has averaged about $4,710 a ton so far this year on the London Metal Exchange.

Renewable sources will account for two-thirds of an estimated $12.2 trillion of investment in energy over the next 25 years, Bloomberg New Energy forecasts. Wind, solar and hydro electricity systems need as much as 12 times more copper than traditional power generation, according to the Copper Development Association.

The threat of dwindling copper supply as demand rises and existing mines are depleted is igniting a new wave of investment in projects, according to MMG Ltd., which is starting up its Las Bambas operation in Peru. Rio this month approved a $5.3 billion expansion to more than double output at Mongolia’s Oyu Tolgoi, while BHP will decide by the end of 2017 on a $2.2 billion copper expansion project in Chile.

‘Late to Party’

A copper deficit may swell to more than 4 million tons from 2023, BHP said in a presentation this month. The producer’s Olympic Dam, Australia’s largest underground mine, is scheduled to raise output by 15 percent to 230,000 tons by fiscal 2021, according to McGill, one of two female asset presidents at BHP.

“We might be a little bit late to the party but we’ll be on track to deliver that and we’ll continue to look for low capital opportunities to maximize the output,” McGill told reporters at the site, about 560 kilometers (350 miles) north of Adelaide. BHP, which produced 1.7 million tons of copper in the year to June 30, declined to comment on potential costs of current Olympic Dam expansion plans.

Not everyone is bullish. Prices have more than halved since a 2011 peak and will remain under pressure if mine supply — forecast to grow about 3 percent a year through 2020 — outpaces demand, Bloomberg Intelligence said in March. More than 4.5 million metric tons of copper mine capacity is planned to come online by 2020, it said. A copper bear market may persist through 2018, according to Goldman Sachs Group Inc.

‘Favorable Shift’

Experiments at a suburban laboratory in Adelaide will need about a further three years to verify processing technology that may allow Olympic Dam to raise copper output to the target of at least 450,000 tons from fiscal 2025. The technology will simplify the mine’s operations and could reduce costs by about 10 percent, according to Justin Bauer, head of resource planning and development.

The potential rise in production is still lower than BHP’s original plan to deliver about 750,000 tons of copper a year from the site. The proposal was ditched in 2012, when BHP said it needed to examine alternative designs and technology to lower proposed costs. Deutsche Bank AG estimated in May 2012 the project would likely cost about $33 billion.

“It’s really the medium-to-longer term market fundamentals that we believe are going to shift in our favor,” McGill said.