Latin America’s mining operations use nearly 60% of the region’s existing solar PV production, Dr. Arnoldus Mateo van den Hurk from Renewables4Mining told Energy and Mines. This demand will only climb further as ore grades decrease and mining comminution takes up more energy.

One of the most important things to consider when investing into solar photovoltaic (PV) market for mining is future demand.

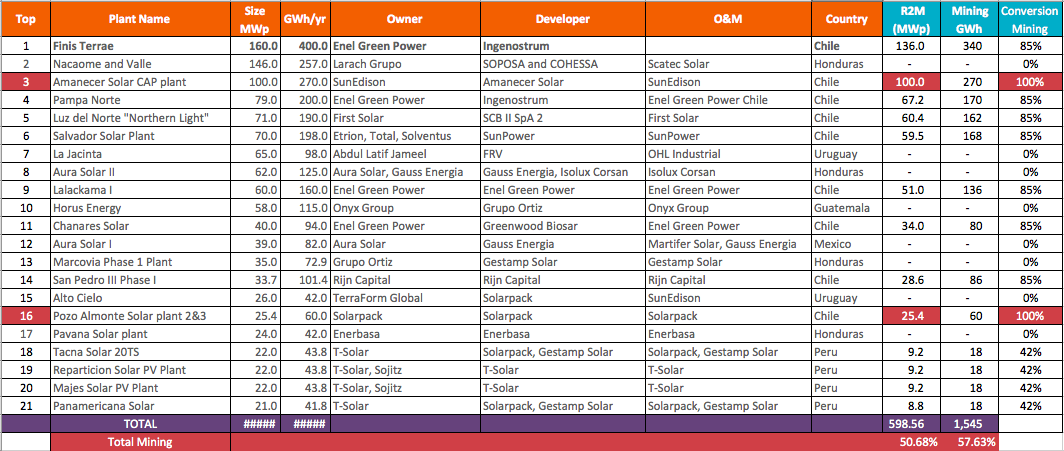

The top 21 solar PV facilities in Latin America, listed in the table below, generate 2,680 GWh annually, with a power capacity of 1,181 MW. Mining companies share 1,545 GWh per year.

Currently, extractive industries use around 10% of global electricity to meet energy needs. However, by 2030 they will require 15%-17%, according to CIRCE (Research Center for Energy Resources and Consumption).

Mines spend over 50% of electricity consumption on comminution — a process of grinding and crushing ores to extract minerals. And, as ore grades decrease with time, the process will require even more energy, Dr. van den Hurk said, pointing to rising future demand.

In fact, mining is likely to be number one renewable energy prosumer sector, the International Renewable Energy Agency’s 2030 roadmap stated last year 2015.

R4M vs. R2M

To get a better glimpse into the market for mining and renewables, one must understand the difference between green energy produced by plants built specifically for mining versus green energy taken from the grid. The market size for the latter is a lot harder to grasp, according to Dr. van den Hurk.

He proposes to separate Renewables for Mining (R4M), which means self-consumption and Renewables to Mining (R2M), which consists of energy taken from the grid.

All of the R4M plants are built to provide power for the mines, unlike the R2M.

Only two solar PV facilities listed in the chart above are R4M (#3 and #16), while eleven are R2M (#1, #4, #5, #6, #9, #11, #14, #18, #19, #20 and #21). R4M’s energy conversion ratio is 100%, but R2M’s ratio varies between 42% and 85%, depending on location.

The R4M facilities include Amanecer Solar CAP plant and Pozo Almonte Solar plants 3 and 16. They are located in northern Chile and were contracted directly with mining companies.

Based on the chart above, R4M statistics are easily summed up, equaling to capacity of 125.4 MWp and an annual consumption of 330 GWh.

In comparison, R2M’s capacity and consumption are “hidden” and thus more difficult to calculate. However, based on governmental official energy statistics, R2M facilities have the power capacity of 473.16 MWp and annual consumption of 1,214.61 GWh.

Moreover, the R2M market is about to expand further, as Chile plans to install over 1,000 MW of solar PV systems in the next six months most of them in mining regions.

All parties involved in mining “need to pay attention to these details in order to develop and invest in Renewables for Mining … [and] should consider this mining approach to renewables to better manage existing facilities and predict future operations in the region,” Dr. van den Hurk concluded.