In a report published in the last few weeks the World Bank has urged African mining companies to improve their revenue and power supply by investing in local power suppliers rather than relying on their own.

The Power of Mine report (download below) didn’t consider the potential role of renewables in any depth and suggests mines (and their communities) would greatly benefit if energy investments were made through their current supplier/utility. The report however does present a number of interest facts on mining energy demand in Africa.

African mining operations have spent about $15.3 billion on electricity investment and operating costs, installing 1,590 MW of capacity since 2000.

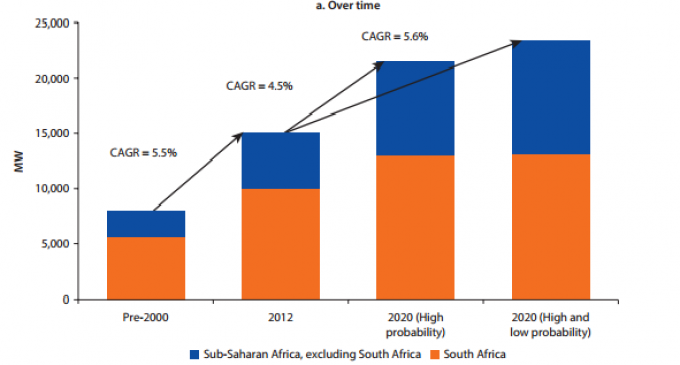

The region’s mining sector required about 7,995 MW in 2000 and more than 15,124 MW in 2012. Mining demand for power in sub-Saharan Africa could reach 23,443 MW by 2020.

It is expected that 10,260 MW will be added to meet mining demand to 2020.

According to Makhtar Diop, the World Bank’s regional vice president for Africa “Power-mining integration can bring substantial cost savings to mines, electrification to communities and investment opportunities to the private sector,” These sentiments echo the views expressed by Steve Letwin, CEO of IAMGOLD, who, in his keynote speech to the Renewables and Mining Summit, said

“Every day, mining companies are developing projects and operating in every corner of the planet, often in places where energy supply, reliability and cost are key considerations. Mining companies and mining projects can actually be tremendous catalysts for the development of a power grid in these regions. Operating mines provide the big, base load, often required to create the economic case for the development of a major power infrastructure.”

The World Bank report is a curate’s egg (i.e.). It recognizes the significant influence and potential of the mining sector as a driver for development and electrification but perhaps fails to recognize the issues of using business as usual power suppliers and sources in Africa.