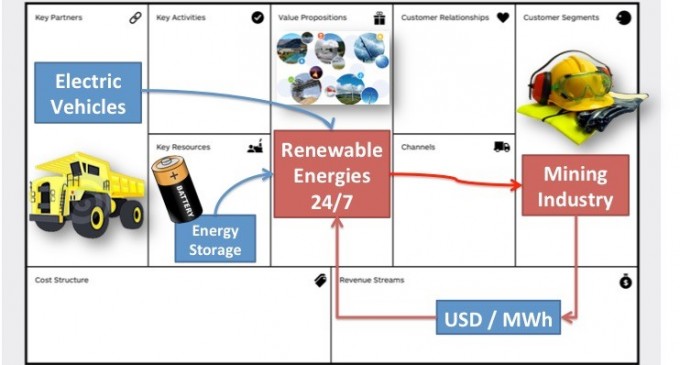

Figure 1: Business Model Approach to Renewables & Electric Vehicles for Mining Industry

By: Arnoldus van den Hurk, CEO, r4mining.com, info@renewables4mining.com

There are two large opportunities for renewable energy in mining: renewables for electricity and renewables for fuel. For both scenarios hybrid energy architecture can be found in the form of hybrid power grids (mini grids) and hybrid fuel vehicles.

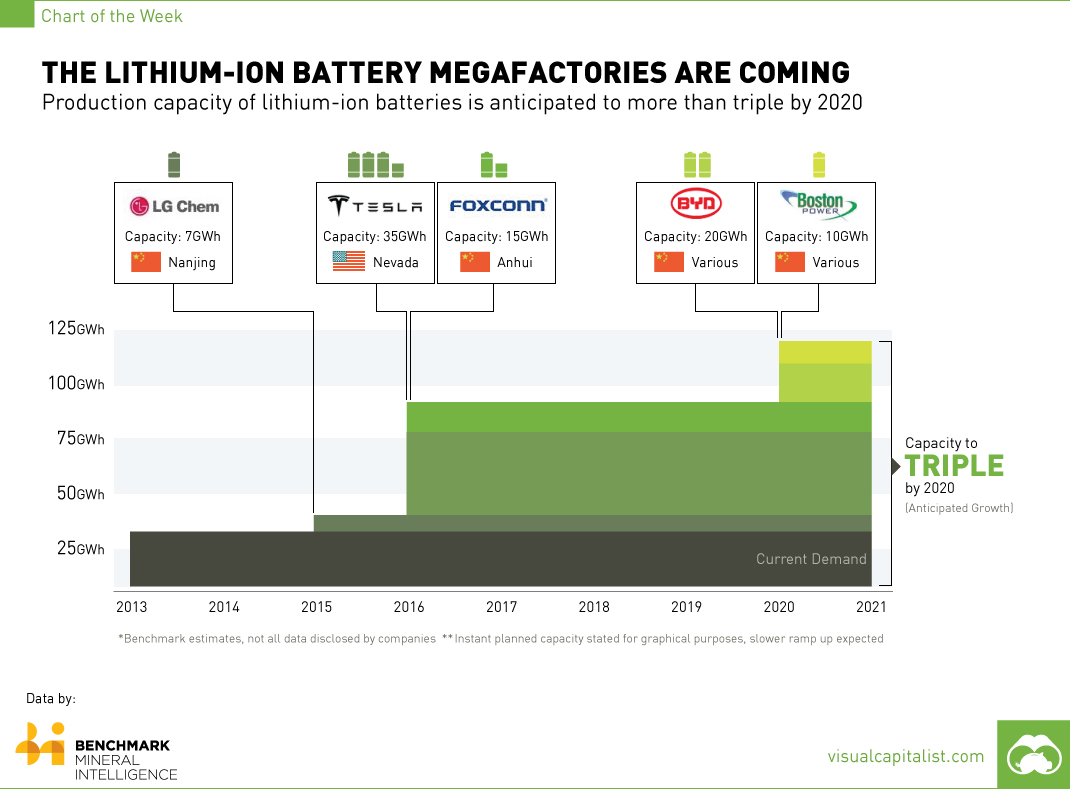

The impetus for electric vehicles in mining is being driven by the increasing competitiveness in the space from Silicon Valley players such as Tesla, Google and Apple and from battery manufacturers including Panasonic, LG and Foxconn.

The price of ion-lithium batteries is following the same trajectory as PV prices over the last decade. The dramatic PV price drop resulted from the development of gigawatt factories in the silicon PV and silicon ingot markets.

History seems to be repeating itself with Tesla’s Gigafactory – a facility focused on electric vehicle and energy storage for the residential renewable marketplace. Some commentators are actually forecasting even steeper reductions in storage prices driven by the momentum building in the convergence of IT, vehicle, residential and utility-scale energy storage.

Figure 2: Tesla Gigafactory. http://www.teslamotors.com/gigafactory

Today, there are 5 – 7 battery giga-factories in construction and another 5 big facilities in the pipeline (see chart below). This explosion of battery technology production will not only disrupt the automobile sector but will also greatly impact mining.

Courtesy of: Visual Capitalist

The combination of renewable resources, electric vehicles and battery technology will transform renewables to a 24/7 energy value proposition for mining. Additionally, the PPA project finance model that is currently being successfully deployed in mine-renewable projects could also be applied to the mining vehicle marketplace too – producing a “Tesla Business Model for Mining” .

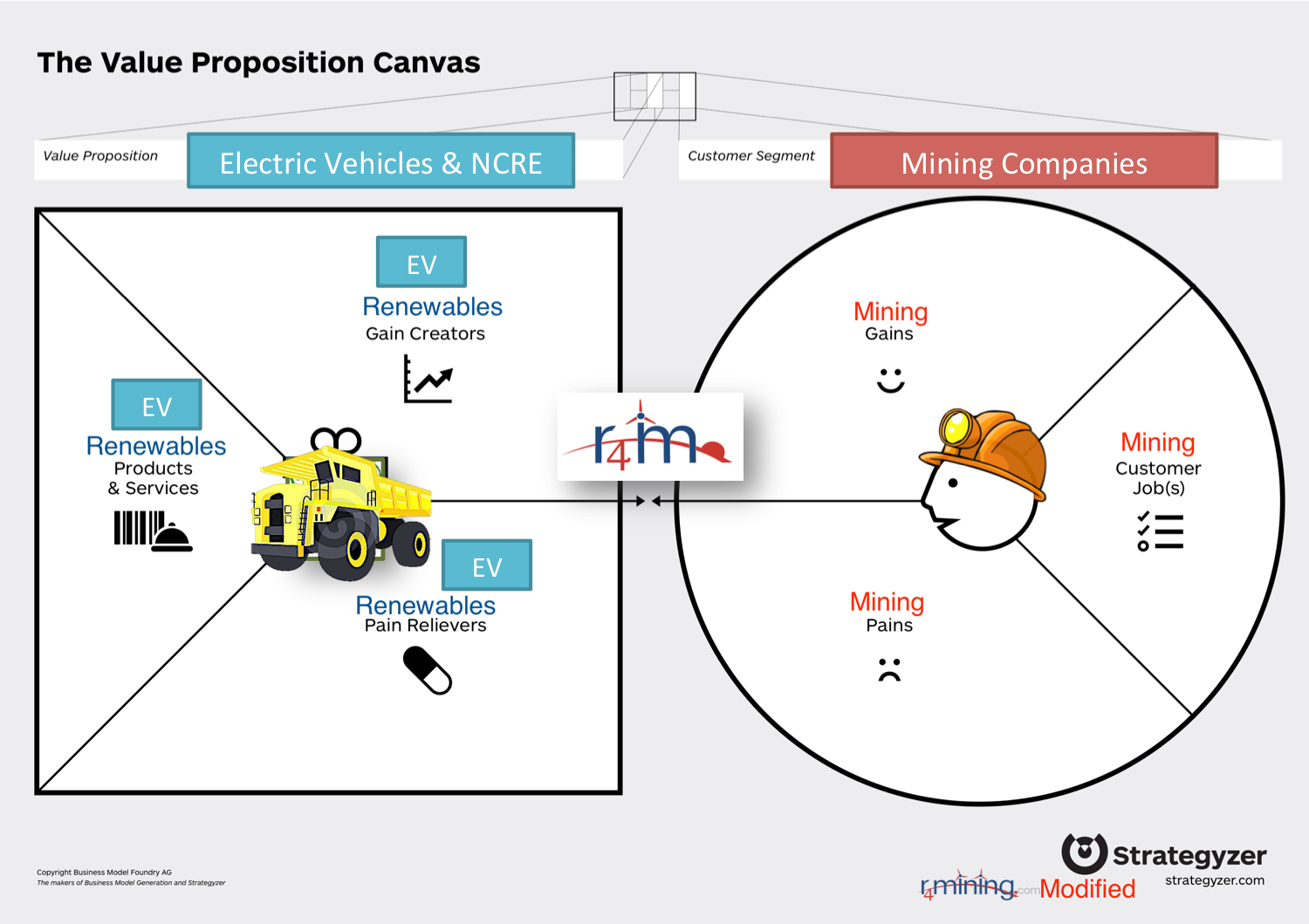

In order to figure out the implications of this dramatic of electric vehicles (EV) in mining, we will look at 7 value propositions for mining with the analysis of Canvas business model I published in a recent article at Energy and Mines.

Figure 3: Value Proposition Design of Canvas Business Model: Application to Electric Vehicles for Mining

Why Electric Vehicles for Mining – Eight Value Propositions

- Electric vehicles are efficient. Electric vehicles (EV) help mining companies that want to increase transport productivity by using reliable, 24/7 renewable energy with 5 times the efficiency of the traditional, internal combustion engine vehicles (ICEVs)

- Renewable energy production and battery storage can provide 24/7 energy supply. However, battery storage is independent of renewables, it can be combined in a hybrid and/or non-renewable generation supply.

- ICEVs have a motor energy efficiency around 18-22% compared with 80-90% efficiency of EV. Most ICEV energy loss is through heat

- EVs are 10 times cheaper to run than ICEVs and the running costs are not susceptible to fuel price volatility

- According to Consumer Goods 2012 and Clean Disruption of energy and transportation, over five years a Jeep Liberty gasoline cost $US 15,000 and a Tesla Roadster would cost $US 1,565 of electricity (12 c$US/kWh).

- One of the NCRE advantages at the Chilean copper mines is linked to the control of the volatility of fuel prices for electricity generation.

- EVs improve profitability by decreasing maintenance costs by 80-90%

- Operations and maintenance costs of EVs in north America and Europe are 87% cheaper than for ICEVs. ICEVs have 2400 moving parts compared with, for example, the 18 moving parts in a Tesla Roadster. There will be 90% fewer repairs during a longer lifetime for the EV.

- EVs integrate significantly better within Big Data, SCADA and other monitoring and control mining systems than current ICEV fleets

- EVs help mining companies who want to promote higher transport security and safety thanks to their increased power, better design flexibility, more traction control and safer fuel storage compared to the more expensive and dangerous ICEV vehicles.

- EVs provide greater opportunities for transport finance such as the PPA business model and bankable capital allocation to the upfront capex investment. The PPA would become the FPA (Fuel Purchase Agreement). Why not pay mining trucks per $US/MWhr?

- EVs help mining companies improve sustainability – they operate with significantly reduced GHG footprint.

- EVs help mines improve the synergies between transport and electricity using these vehicles as “moving power grid” storage, which contributes to the overall mining facility management.

- Last but not least, EV are critical in underground mining, not only replacing diesel and their impact in air quality and safe healthy work ambient, but also by the reduction of energy cost linked to ventilation. Ventilation costs represent between 55% to 70% of total power costs.

The details of the above value proposition and business model will be one of the subjects discussed at Energy and Mines London Summit workshop – An Essential Introduction to Mining for Renewables Professionals. Please don’t hesitate to send me any comments you want to share about these subjects to info@renewables4mining.com.