The incentive for a mine to reduce its carbon footprint has received a shot in the arm from the relentlessly declining costs of wind, solar, and energy storage, says Greentech Media.

Projections by Wood Mackenzie show the cost of energy storage in 2022 will be 61 percent less than what prevailed in 2013, while the cost of solar will be 40 percent lower.

With energy accounting for between 15% to 40% of a mine’s total operating costs, clean energy options have therefore become extremely interesting to miners from the economic standpoint.

Adding to the financial benefits are savings in logistic efforts. For example, a mine in a remote and inaccessible location must deal with the hassles of transporting expensive fuel through long, hazardous, and often lawless distances.

Further, a captive, clean and dependable power source presents a huge advantage over erratic and unreliable grid power to such remote mines.

Case Study: B2Gold

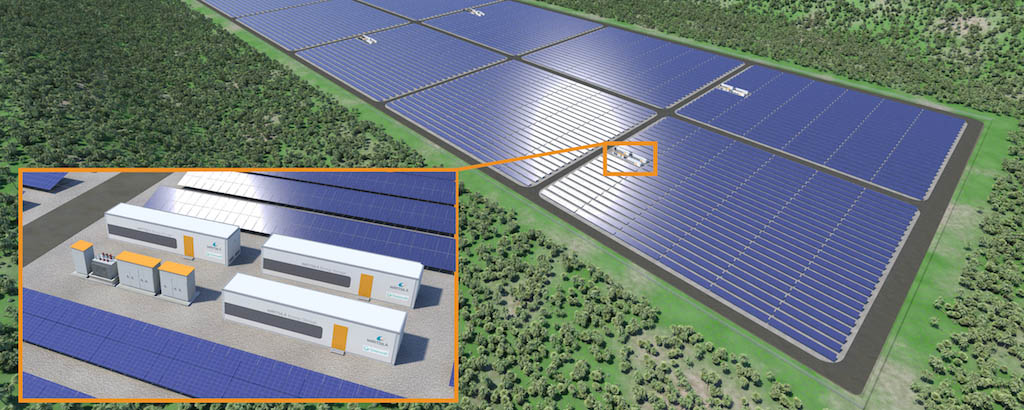

Canadian gold mining company B2Gold announced last year plans to add solar plus energy storage to its fuel-powered engines at the Fekola mine in southwest Mali. The solar-plus-engine-plus-storage power solution will be optimized using Wärtsilä’s GEMS technology.

The plan will help the mine to cut costs by approximately 7% and carbon emissions by 39,000 pounds annually. Besides, it would reduce the purchase and transport of millions of liters of heavy fuel oil.

Wärtsilä is leveraging its previous experience in developing microgrids for islands, such as the Caribbean island of Bonaire, for mining applications such as in Fekola.

Long-term cost-benefit planning

According to Greentech, given the favorable economics, greenfield mines will certainly prefer renewables plus energy storage, or a pure renewable system, for their power needs.

For an existing site, however, the economics would have to be calculated with reference to balance mining life and forward prices of the mining output.

Read the Greentech Media article HERE.

Image Source of Hybrid Solar: Wartsila